Tax prepayments : surcharge increased to 9% !

The surcharge due in the event of insufficient or no tax prepayments has been increased from 6.75% to 9% for financial years beginning on or

The surcharge due in the event of insufficient or no tax prepayments has been increased from 6.75% to 9% for financial years beginning on or

The Program Law of 22 December 2023 strengthens the CFC rule, introduced in Belgium in 2017 following to the ATAD Directive. The CFC rule aims

In real estate development (new residential projects), the building is often sold to the buyer by one company and the land by another. The Ghent

The tax authorities have just published the percentages applicable for the investment deduction relating to investments of tax year 2024. Due to inflation, these rates

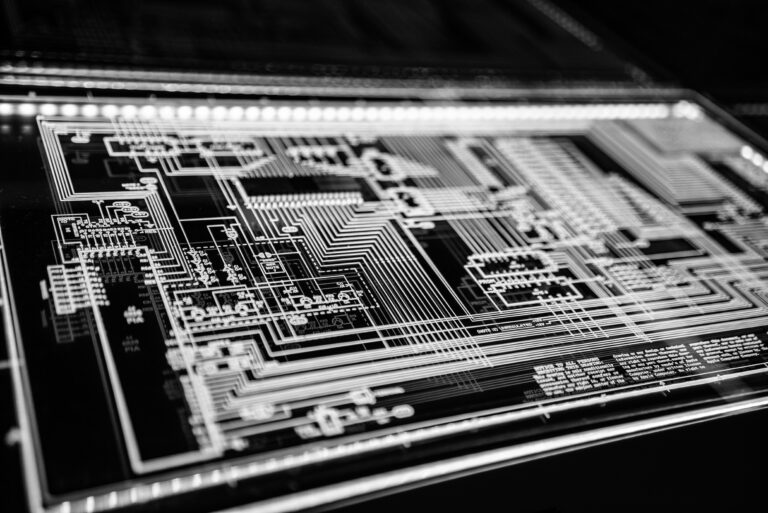

The Law of 28 March 2022 introduced a limitation of the basis for calculating the R&D tax credit insofar as it includes capitalized salary expenses

The tax authorities have just published an administrative circular concerning the timing of the registration with Belspo for the exemption from the payment of the

Last week, the Minister of Finance presented his tax reform project. Among the measures proposed is an adjustment of the eligibility conditions for the innovation

R&D costs capitalized may qualify for a one-time R&D tax credit (13.5%) or a spread tax credit (20.5% on the depreciations). Development costs must be

On March 2, 2023, David De Backer and Aymeric Jungbluth, member of the board of the ruling commission, will host a webinar in which the

A new legislation prevents the combination of the R&D tax credit and the wage tax exemption for researchers (amendment to article 289quater of the Belgian

The tax regime for copyright income has been modified by the program Law of December 26, 2022. What does the new law provide? The